By Jason Parker, WRAL TechWire | July 12, 2018

Editor’s note: WRAL TechWire reports regularly about the three leading venture capital reports that are distributed on a quarterly basis: PitchBook-National Venture Capital Association, PricewaterhouseCoopers-CB Insights MoneyTree, and Dow Jones VentureSource. Because each report has its own sources and requirements for what is considered venture capital, the data varies and thus the numbers for North Carolina as well as national are different most of the time. We encourage you to read each of the three reports which can be found under the tag “Startups -Funding” at the top of the WRAL TechWire home page.

RESEARCH TRIANGLE PARK – Investors are finding more deals across North Carolina this year at the fastest pace since 2000, according to new data from the DowJones VentureSource report.

In taking the measure of venture capital activity in the first half of 2018, the VentureSource report released today tracked 22 deals in the second quarter compared to 19 in the first quarter.

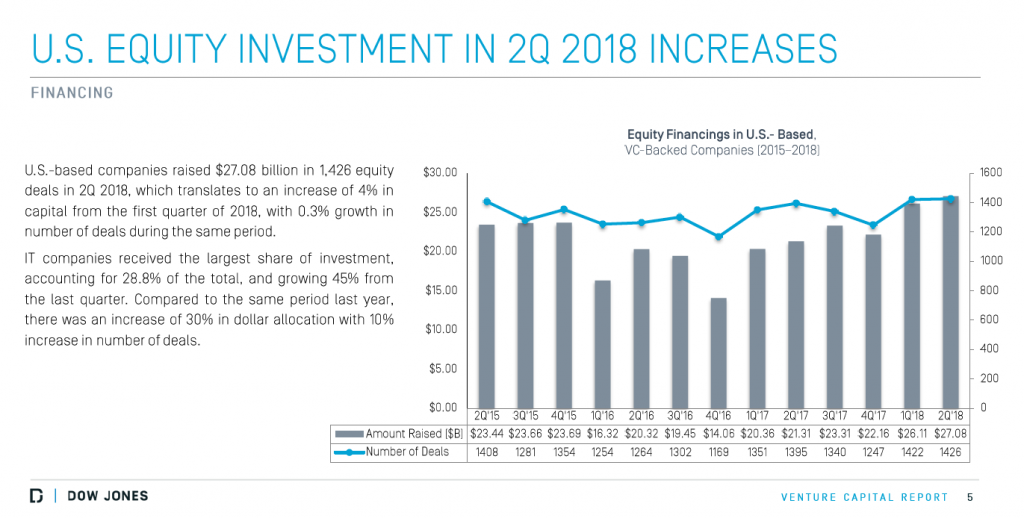

Though the report found that venture capital fundraising was the highest it has been in the last three years during this quarter in the amount invested and in the number of deals, North Carolina action still represented a small portion of 1,426 deals nationwide in the second quarter and 41 of 2,848 from January through June, according to the report.

The total deal value for North Carolina companies in the second quarter was $483,460,000, up considerably from $356,660,000 in the first quarter of 2018.Deal making in North Carolina through the first half of the year also was up from 39 through the first half of last year.

VC funding increases in Q2, says Dow Jones VentureSource

“The fundraising environment is good right now,” said Ben Weinberger, co-founder of DigitalSmiths and the first chief product officer at SlingTV, in an interview this week. If you’re considering whether or not to raise money, now might be a good time to begin the fundraising process because the competition for talent is also the toughest it has been in two decades, said Weinberger.

Nationally, funding increased 4 percent from the first quarter to more than $27 billion, VentureSource noted.

The second-quarter deals included five life sciences companies and four software companies, as well as two construction companies, two networking companies, two hardware companies, and a financial services company.

BIOTECH FIRMS LEAD Q2 2018 INVESTMENT ACTIVITY

Leading the deals in terms of total deal value was a pair of Durham’s life science companies, Humacyte Inc. and Precision BioSciences Inc. Humacyte raised $150 million from Boston-based Fresenius Medical Care to commercialize bioengineered blood vessel technology and later named Jeffrey Lawson as the company’s new president and CEO. Precision BioSciences raised $110 million in a Series B round to advance genome editing, led by ArrowMark Partners.

Charlotte’s CTG LLC, a wireless communications company that builds communication towers, raised $38,300,000 from ten investors and Greensboro’s Guerrilla RF Inc. raised $3,800,000 in angel funding, according to the report, which is $2,000,000 than WRAL TechWire reported in April 2018when the funding round was still open.

Raleigh’s Muzik Inc. raised $70,000,000 in angel funding, and two more Durham-based life science companies, StrideBio Inc. and Valencell Inc. also raised funding rounds to the tune of $15,700,000 and $10,500,000.

Durham’s First Leads Inc., a real estate startup, closed $5,000,000 and Charlotte’s Somnoware Healthcare Systems Pvt. Ltd. raised $3,500,000 to continue to expand operations to scale a SaaS product that provides workflow automation, care management, and population risk analysis for COPD and sleep apnea care providers.