By Jason Parker, WRAL TechWire | July 10, 2018

RESEARCH TRIANGLE PARK – Venture capital investors are investing at a record pace so far in 2018.

In the second quarter, 38 North Carolina companies closed venture capital funding to the tune of a combined $411,300,000 in investment, the new quarterly PitchBook-NVCA Venture Monitor report shows.

This is slightly down from the first quarter of 2018, when 41 companies raised $456,880,000 across the state.

But the six-month total of $868.1 million nearly matches all the funding raised by startups and entrepreneurial companies in 2017 and has topped the total for all of 2016.

If the deal making continues, North Carolina will top the $1.3 billion raised in 2015 – the banner year for funding according to Pitchbook data that dates back to 2006. Nationally, 3,912 venture-backed companies reached a total of $58.5 billion invested in 3,997 total deals in the first half of 2018, according to the PitchBook-NVCA Venture Monitor report.

“The first half of 2018 shows that the investment environment for venture-backed companies is just as robust as it was in 2017, and 2018 may end up even stronger than that banner year,” said Bobby Franklin, CEO of NVCA. According to the data, the highest amount of capital deployed into the nation’s entrepreneurial ecosystems since the early 2000’s was last year, in 2017.

“The sheer amount of capital available across the entire venture landscape is reaching unprecedented levels,” said John Gabbert, founder and CEO of PitchBook in a statement.

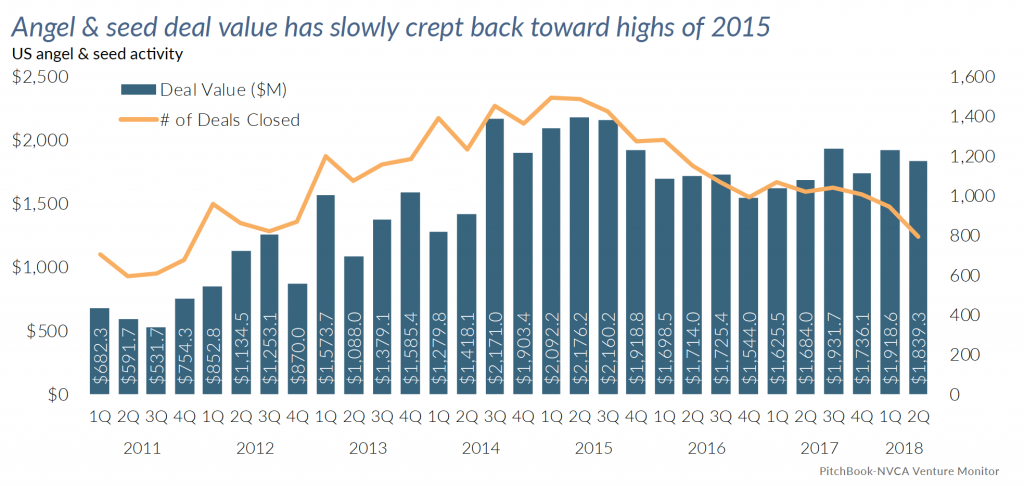

Deal value was driven in part by investment in late-stage companies and unicorns, however, deal sizes increased across all stages, the report found, and is most notable in the angel and seed stage, boosted by the emergence of pre-seed financings.

Tracking early-stage deals

The average deal size for angel rounds and seed rounds is increasing—$830,000 for angel funding and $2.1 million for seed rounds—which would set a ten-year high if the averages hold for the rest of the year. The median valuation for these companies is $7 million, twice as high as the median valuation in 2012, and nearly $1 million higher than the median valuation in 2017.

“Once startups are able to produce solid business metrics and establish a business model capable of scaling quickly, they see high demand from venture investors looking to put their capital to work,” said Gabbert.

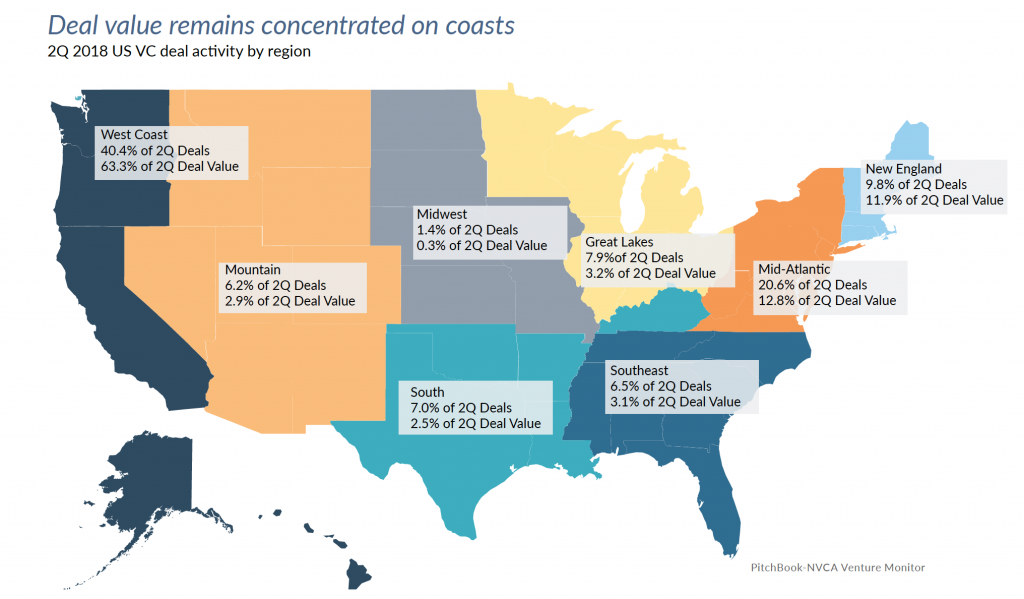

DEAL VALUE CONCENTRATED ON COASTS

Where deals were made

Unsurprisingly, deal value continues to remain concentrated on the coasts, with 63.3 percent of the total deal value in the second quarter funnelled into companies based on the west coast, despite only representing 40.4 percent of the deals inked nationwide.

The mid-Atlantic region captured 12.8 percent of the deal value in 20.6 percent of the deals, and New England captured 11.9 percent of the deal value with just 9.8 percent of the total deals.

The southeast captured just 3.1% of the deal value in 6.5% of the deals, totalling 121 total deals at a combined value of $886,500,000.

EXIT ACTIVITY

There were 419 venture-backed exits in the first half of 2018, worth $28.7 billion, according to the report. This type of activity puts 2018 on pace to match exit counts from 2017. While exit value dipped slightly from compared to the first half of 2017, exits of $500 million or more accounted for roughly 50 percent of capital exited in the last two quarters.

For instance, in the second quarter the acquisitions of Flatiron ($1.9 billion), Ring ($1.2 billion) and Glassdoor ($1.2 billion) were landmark deals that helped drive exit value. This trend will likely continue throughout 2018 with several additional unicorns poised for a solid exit.

A closer look at exit types shows the IPO market remained healthy and is on pace for the second-best year in the past decade, with regard to total IPO count, as there have already been 43 IPOs and $6.3 billion in exit value completed.

The largest public debuts of the quarter included DocuSign ($629 million), PluralSight ($310 million) and SmartSheet ($174 million). It’s also worth noting, eight companies debuted at a valuation above $1 billion in the second quarter.

Additionally, as venture-backed business models continued to mature, private equity-backed buyouts accounted for a higher proportion of exit counts. There were 27 buyouts totaling $2.0 billion in the second quarter. According to the report, 2018 may reach the same level of buyout activity as in 2017, which saw more buyouts (154) as a venture-backed exit strategy than any year prior, as measured by the report.