By Rob Wright, Life Science Leader | May 31, 2019

$1.7 billion.

That was the entire digital therapeutics market in 2017. While that’s a little more than most people have in the bank, it’s still a fairly small number for most Big Pharmas. But that market is projected to grow at rate of 20.5 percent through 2025, which will make it nearly $8 billion. And yet, that’s not even half what AbbVie brought in last year — from just one product (i.e., 2018 sales of Humira equaled $19 billion)!

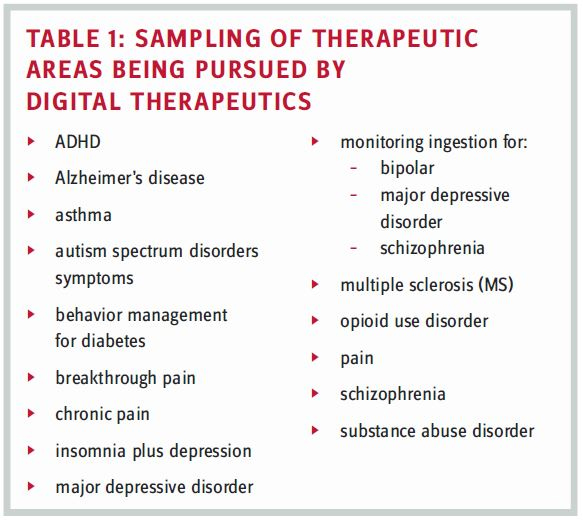

So, why should pharma care about digital therapeutics? This was just one of the questions posed to a panel of digital therapeutics experts during the 2018 CNS Summit. Hailing from Akili Interactive Labs, Applied VR, Dthera Sciences, Novartis, Otsuka, and Pear Therapeutics, their collective backgrounds are impressive (i.e., physicians and Ph.D.s) with diverse experiences that include biotech, clinical research, FDA, and pharma (i.e., big, rare disease, small, and specialty). Just as impressive are some of the therapeutic areas in which they are working to find (or have found) digital treatments, either as mono or adjunctive therapies (see Table 1).

WHAT IS A DIGITAL THERAPEUTIC?

Before we tackle whether pharma should care, let’s first define what a digital therapeutic is. “Part of the reason ‘digital therapeutic’ even became a term is that digital health got co-opted by medical records,” stated Edward Cox, CEO of Dthera Sciences. When you say digital health, people tend to think about electronic health records (EHRs). But implementation of EHR isn’t digital health; it’s the digitization of a sector. As a result, digital therapeutics began to be used as a catch-all for lots of digital technologies that drive therapeutic outcomes. “I can think of various companies that probably all have a pretty good claim to be a digital therapeutic, but their products range from things that look like drugs, to medical devices, diagnostics, consumer health, or even hospital services,” he added. But such an all-encompassing approach feels too broad. One panelist defined what his company does with digital therapeutics as the development of “prescription video games.” Such a simplistic definition seems fairly narrow, especially when you consider Otsuka and Proteus Digital Health, which gained FDA approval in 2017 for ABILIFY MYCITE, a drug-device combination product composed of oral aripiprazole tablets embedded with an ingestible event marker sensor that also includes a patch (wearable sensor), a smartphone application, and web-based portals for healthcare providers and caregivers. To reduce confusion, let’s turn to the formal definition published by the Digital Therapeutics Alliance (DTA) in October 2018.

Digital therapeutics (DTx) deliver evidence-based therapeutic interventions to patients that are driven by high-quality software programs to prevent, manage, or treat a medical disorder or disease. They are used independently or in concert with medications, devices, or other therapies to optimize patient care and health outcomes.

SO WHY SHOULD PHARMA CARE ABOUT DIGITAL THERAPEUTICS?

This question was posed to each panelist. The first responded by noting how the pharma landscape has evolved from only small molecule to large molecule, and many modalities in between. “It always has been hard to deliver good therapy, but doing so digitally wasn’t possible 30 years ago,” he stated. But today it is part of the puzzle needed for better patient care, and if pharma doesn’t care, they’re missing out. Another panelist added, “You’ve probably heard the expression, ‘people don’t buy drills, they buy a hole in the wall.’ Whether our customers are payers, providers, or patients, they don’t buy drugs, injections, or devices; they buy getting better.” According to this panelist, pharma should care because digital therapeutics provide an opportunity for pharma to be a good partner with amazing technologies serving the market. “Pharma should care because digital therapeutics are proving to be as effective, if not more so, than traditional medicines,” yet another panelist attested.

With the exception of Otsuka’s approach to monitoring ingestion and some others that focus on behavior modification (i.e., coaching in non-CNS indications), many digital therapeutics are focused on the neck up (i.e., CNS), which is another reason pharma should care about DTx. “Pharma has beaten back many of the top killing diseases,” asserted Cox. But targeting CNS has provided a much different story. “We have no cures for Alzheimer’s or Parkinson’s,” he continues. A fellow panelist added, “When we think of the burden of disease as it relates to cost, digital therapeutics provide an incredible opportunity to perhaps realize success in an area where we have primarily witnessed failure.” But doing so requires biopharma, hospitals, patients, payers, and providers not only to reimagine how healthcare is delivered but also to reconsider what constitutes a therapeutic. “In areas where pharma has not delivered a therapy, it is time to look for different discovery approaches beyond the lab,” shared another panel member. However, the panelists seemed in agreement on the importance of not pigeonholing digital therapeutics to just CNS.

Here’s another reason pharma should be interested in digital therapeutics. “The method of developing digital therapeutics maps very well to how we approach discovery and development in pharma,” a different panelist asserted. “You build the basic science and mechanisms of action, run clinical trials using the same endpoints to evaluate a medication, and then go through the FDA.” On the back end, patients, payers and providers still need to be educated on the medical value, which aligns well with biopharma’s commercial engine (though sales representatives might require some new skills).

But biopharma’s success in digital therapeutics requires a mind shift. One panelist noted how many pharmas view digital therapeutics as an interesting little thing to give away that will help them sell more drugs. “We are not in the business of being the toy in the happy meal,” another panel member affirmed.

Want another reason why pharma should be interested in digital therapeutics? For starters, every new sensor creates an opportunity for intervention. But an even more exciting opportunity is the ability to take in data through the digital therapeutic itself and to then phenotype patients and personalize their treatment. With true digital therapeutics, you know at every moment how the patient is doing, allowing providers the opportunity to intervene and adjust the therapy when necessary.

WHAT ARE SOME OF THE CHALLENGES FOR DIGITAL THERAPEUTICS?

While digital therapeutics hold enormous promise, there remain plenty of challenges, one being reimbursement. “By going through the FDA, getting a label and an indication statement, you have a unique device identifier that facilitates CPT (current procedural terminology) coding,” a panel member explained. This fits with what insurance companies are used to. But digital therapeutics companies still need to build contracts and coverage on health economic outcomes and the medical value created. While Medicare and Medicaid are not yet reimbursing for digital therapeutics, panel members believe they will get there. “Patients with substance abuse disorder are often on Medicaid,” a panelist elaborated. If such patients aren’t treated, they tend to place a significant financial burden on the state when ending up in the ER or criminal justice system.

“How should they be priced?” asked an audience member. For example, imagine that a digital therapeutic proves to have better outcomes and better adherence than a $60,000 drug for MS. Is it worth more, the same, or less, or is it priced based on its cost of development? “We’re thinking about it a little bit more broadly,” a panel member responded. “But how such a digital therapeutic is priced should have nothing to do with whatever is charged for a pharmacological therapy.”

“How does the process work when outsourcing the clinical trial of a digital therapeutic?” asked another audience member. “It’s actually a big cultural change in how we interact with our CROs,” a panelist shared. In the traditional clinical trial model, there are delays in starting to get data, the ability to review, and give feedback. Such isn’t the case with digital therapeutics, which is certainly a positive. But execution requires more involvement from the sponsor. “You can’t just do a hand off as you would with a small molecule trial,” he elaborated. In addition, the sponsor could no longer afford to do paper-based clinical trials. Further, that company would find it needed to integrate around 12 or so technology systems in order to do clinical trials with CROs. “One site commented that they feel like Radio Shack because of all the equipment we supplied to do the trial,” he laughed. However, another panelist noted that figuring out how to do trials innovatively is top of mind for CROs (at least the 10 biggest anyway).

Another challenge is the FDA approval process. When Pear Therapeutics got the FDA’s approval for re- SET and reSET-O, it was approved as a medical device. Although the medical device review process is generally simpler than the review of drugs, there are many uncertainties due to the complexities of working with software based products, most importantly the need to make iterative software updates during the lifecycle of the product. “The FDA is currently trying to come up with a regulatory framework that works better for digital therapeutics,” a panelist stated.

A couple of final points. For every approved prescription drug, there exists a monograph. What might the monograph for a prescription digital therapeutic look like? The digital therapeutic industry is working with groups like the U.S. Pharmacopeia to envision how this should be done, along with figuring out how these should be prescribed and delivered to patients via an e-pharmacy, while also being HIPAA compliant. “There are all sorts of things that essentially have never been done before, and figuring those out is another component that makes working in digital therapeutics challenging and exciting,” a panelist finalized.

CORE PRINCIPLES OF DIGITAL THERAPEUTICS

According to the Digital Therapeutics Alliance (DTA), the following are core principles all digital therapeutics must adhere to:

- prevent, manage, or treat a medical disorder or disease

- produce a medical intervention that is driven by software, and delivered via software or complementary hardware, medical device, service, or medication

- incorporate design, manufacture, and quality best practices

- engage end users in product development and usability processes

- incorporate patient privacy and security protections

- apply product deployment, management, and maintenance best practices

- publish trial results inclusive of clinically meaningful outcomes in peer-reviewed journals

- be reviewed and cleared or approved by regulatory bodies as required to support product claims of risk, efficacy, and intended use

- make claims appropriate to clinical validation and regulatory status

- collect, analyze, and apply real world evidence and product performance data